Cockpit interface

Format Description a alphabetical as alphabetical with special characters n numeric an alphanumeric ans alphanumeric with special characters ns numeric with special characters bool boolean expression (true or false) 3 fixed length with 3 digits/characters ..3 variable length with maximum 3 digits/characters enum enumeration of allowed values dttm ISODateTime (YYYY-MM-DDThh:mm:ss) Abbreviation Description CND condition M mandatory O optional C conditional Notice: Please note that the names of parameters can be returned in upper or lower case.Definitions

Data formats

Abbreviations

Comment If a parameter is mandatory, then it must be present If a parameter is optional, then it can be present, but it is not required If a parameter is conditional, then there is a conditional rule which specifies whether it is mandatory or optional

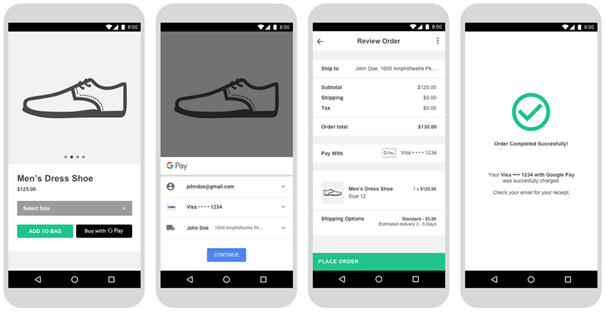

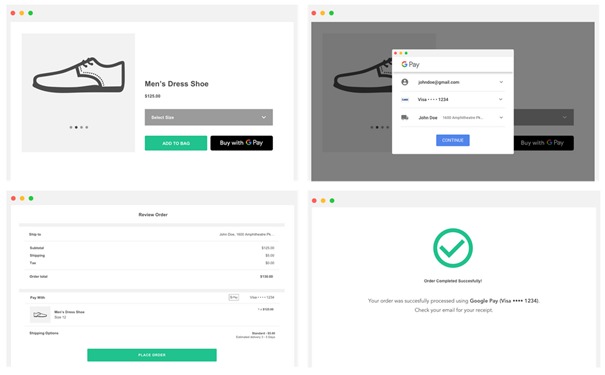

Calling the interface

Two transactions are created when making a credit card payment via Google Pay. In the Google Pay transaction the required credit card data are determined first and the actual credit card transaction is then carried out automatically. This takes place via a server-to-server connection and supports all usual credit card transaction options. The difference here, however, is that you don't transmit the credit card information, which you don't know. Instead, you transmit the Token generated by Google Pay, which contains the required credit card data in encrypted form.

In order to make a credit card payment with Google Pay, please use the following URL:

https://www.payjet-cockpit.de/googlepay.aspx |

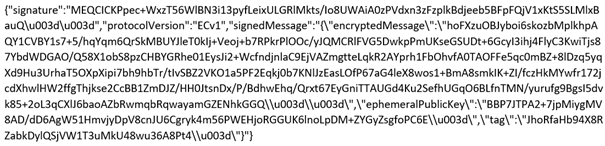

Notice: For security reasons, Pay-Jet Cockpit rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter. The following table describes the encrypted payment request parameters:

In addition you can submit any parameters that are applicable or required for a credit card payment (without credit card data). More information about this you can find within Card processing.

Parameters for Google Pay

The following table describes the result parameters with which the Pay-Jet Cockpit responds to your system pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the key (e.g. MerchantId, RefNr) should not be checked case-sentive

Result parameters for Google Pay

Capture / Credit / Reversal

Captures, credits and reversals do not refer to the Google Pay transaction but directly to the credit card transaction. More information about this you can find within Card processing.

Batch processing via the interface

Captures, credits and reversals via batch do not refer to the Google Pay transaction but directly to the credit card transaction. More information about this you can find within the document Card processing.